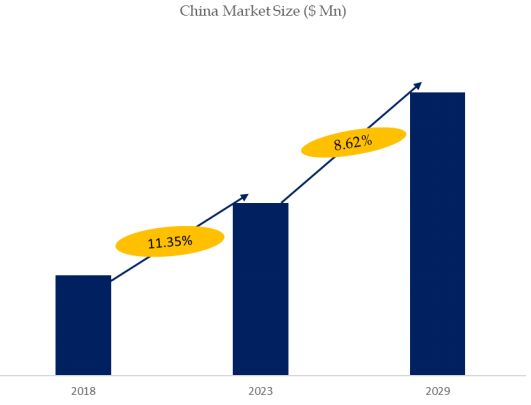

The china Commercial Property Insurance market size is projected to grow from USD 235,656.26 million in 2023 to USD 387,023.88 million by 2029

Published Date: Sunday,02 Jun,2024

Commercial Property Insurance Market Summary

Commercial Property Insurance is a type of insurance coverage that provides protection for businesses against financial losses related to their physical assets. This type of insurance typically covers buildings, contents, equipment, inventory, and other property owned by a business. The policy is designed to help businesses recover from losses due to events such as fires, theft, vandalism, natural disasters, and other covered perils.

According to the new market research report "China Commercial Property Insurance Market Report 2023-2029", published by GIResearch, the china Commercial Property Insurance market size is projected to grow from USD 235,656.26 million in 2023 to USD 387,023.88 million by 2029, at a CAGR of 8.62% during the forecast period.

- China Commercial Property Insurance MarketSize(US$ Million), 2018-2029

Source: GlobalInfoResearch, “Global Commercial Property Insurance market 2024 by Company, Regions, Type and Application, Forecast to 2030”(published in 2023). If you need the latest data, plaese contact GIResearch.

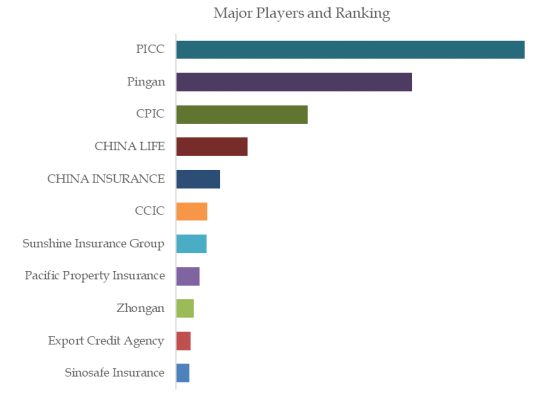

- China Commercial Property Insurance Top11Players Ranking and Market Share (Ranking is based on the revenue of 2023, continually updated)

Source: GlobalInfoResearch, “Global Commercial Property Insurance market 2024 by Company, Regions, Type and Application, Forecast to 2030”(published in 2023). If you need the latest data, plaese contact GIResearch.

This report profiles key players of Commercial Property Insurance such as PICC, Pingan, CPIC, CHINA LIFE, CHINA INSURANCE.

In 2023, the China top five Commercial Property Insurance players account for 74.65% of market share in terms of revenue.

Market Drivers:

Economic Conditions: Economic factors play a significant role in the demand for Commercial Property Insurance. Economic growth, construction activities, and the overall health of businesses influence the need for coverage to protect physical assets.

Real Estate Trends: The state of the real estate market, including property values, construction costs, and occupancy rates, can impact the Commercial Property Insurance market. Changes in property values may necessitate adjustments in coverage limits.

Natural Disasters and Climate Change: Increased frequency and severity of natural disasters and the potential impact of climate change can drive demand for Commercial Property Insurance. Businesses seek coverage to protect against risks such as floods, hurricanes, earthquakes, and other weather-related events.

Restraint:

Catastrophic Events and Losses: The occurrence of large-scale catastrophic events, such as natural disasters or major accidents, can lead to substantial losses for insurers. These events may strain the financial capacity of insurance companies and result in increased premiums or reduced coverage options.

Regulatory Compliance: Stringent regulatory requirements and compliance standards can pose challenges for insurers. Compliance with changing regulations may require adjustments to policies and operational processes, potentially increasing administrative burdens and costs.

Global Economic Uncertainty: Economic downturns or global economic uncertainties can impact the demand for commercial properties and, subsequently, the need for Commercial Property Insurance. Businesses may reduce their coverage or seek cost-cutting measures during challenging economic times.

Opportunity:

Cyber Insurance Demand: The increasing frequency and sophistication of cyber-attacks present a significant opportunity for insurers. There is a growing demand for specialized Cyber Insurance coverage to protect businesses from financial losses associated with data breaches, ransomware attacks, and other cyber threats.

Innovation in Risk Assessment: Advancements in data analytics and risk modeling technologies offer opportunities for insurers to enhance their risk assessment capabilities. By leveraging big data, artificial intelligence, and machine learning, insurers can better understand and underwrite complex risks.

Globalization of Businesses: With businesses expanding globally, there is an opportunity for insurers to provide coverage for properties located in different regions. Tailoring insurance solutions to address the specific risks associated with international operations can be a growth area.

Contact Us:

If you have any questions or have further requirements about this report, please contact us.

GlobaI Info Research Co.,Ltd

Website: https://www.globalinforesearch.com

TEL: HK: 00852-58030175

TEL: US: 001-347 966 1888

E-mail: report@globalinforesearch.com

About Global Info Research:

Global Info Research is a report publisher, a customer, interest-based suppliers. Is in the best interests of our clients, they determine our every move. At the same time, we have great respect for the views of customers. With the improvement of the quality of our research, we develop custom interdisciplinary and comprehensive solution. For further development, we will do better and better. GlobalInfoResearch will with excellent professional knowledge and experience to carry out all aspects of our business. At the same time, we will thoroughly look for information, to give a more comprehensive development.

Global Info Research has more than 30000 global well-known customers, covering more than 30 industries, research regions cover China,Japan,Korea,US,EU,Asia,Middle East and Africa,South America,Australia,etc.

Previous News:

The global Congenital Heart Occluder market size is projected to grow from USD 260.9 million in 2023 to USD 357.8 million by 2029

Next News:

The global Contactless Smart Card and Security Chip market size is projected to grow from USD 1,269.3 million in 2023 to USD 1,634.1 million by 2029

Global Info Research promotes respect for and protection of intellectual property. If you are aware of any copyright or other problems with any article on this site, please contact us and we will deal with you promptly. Contact details: report@globalinforesearch.com

Popular Product Keywords

- We Provide Professional, Accurate Market Analysis to Help You Stay Ahead of Your Competition.Speak to our analyst >>

Our Clients

What We Can Provide?

With better results and higher quality products,Our professional reports can achieve four things:

Insight into the industry market information

Analyze market development needs

Prospects for future development

Develop industry investment strategy

- Digging deeper into global industry information and providing market strategies.Contact Us >>

Popular Product Keywords

- We Provide Professional, Accurate Market Analysis to Help You Stay Ahead of Your Competition.Speak to our analyst >>

Our Clients

What We Can Provide?

With better results and higher quality products,Our professional reports can achieve four things:

Insight into the industry market information

Analyze market development needs

Prospects for future development

Develop industry investment strategy

- Digging deeper into global industry information and providing market strategies.Contact Us >>